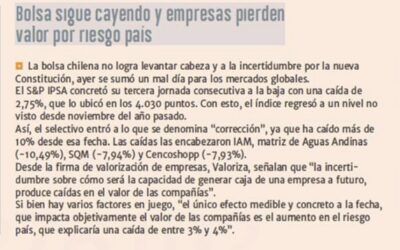

How the third retirement has affected the valuation of companies in the medium term was the study conducted by the Valoriza team and published on Monday, May 3, 2021 in Diario Financiero. It mentions that an eventual tax increase to finance future pensions and uncertainty could reduce the value of companies by between 2% and 4.5%. It also points out that in the short term, companies linked to consumption will benefit.

The study identifies three different effects of the third withdrawal for listed companies: the first was positive and short-term, where the greater liquidity of individuals will generate an increase in consumption. The second, of an adverse nature and with medium and long-term effects, is related to the fact that close to half of the contributors will be left without savings, which should translate into a tax increase in the medium term, since it will be necessary to finance the pensions of millions of people who will not have the resources to retire.

El tercer efecto, también adverso, es que este retiro del 10% agrega incertidumbre, tanto política como en materia de negocios, lo que hace difícil predecir resultados bajo un escenario más bien incierto. Esto tendría un costo para las empresas chilenas , que, llevado a medio puntos adicional de tasa de descuento, en promedio equivaldría a una caída en torno al 3%.

Click here to read the news.