The valorization of companies is a complex process. However, there is one or another formula to enhance the value of your companywhich can help you determine how much your business is really worth today.

There are different types of formulas to be able to establish the correct valuation of companies, but the most reliable is discounted cash flow valuation.

In order to be able to calculate this, it is necessary to have certain knowledge in finance and accounting, in addition to having access to all the up to date information of the company's books.

The final value for the valorization of companieswill depend on the value of the variables established, as in the case of the value of the discount rate. Valuing a business through cash flows is the best way to determine how much it is really worth.

Depending on the type of company or business and the information presented, you will have to use a formula for the valorization of your company.

It is well known that, for a valorization of companiesThere is no single method, there are several that help this process.

What formulas exist for valuing a company?

Through discounted cash flow

The discounted cash flow method is the most reliable method to be able to correctly perform a valuation of companies. This formula consists of valuing a company based on its capacity to generate future free cash flows (FCF).

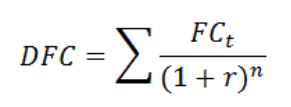

To establish this correctly, it is necessary that the cash flows are updated up to date. The formula to enhance the value of your company and determine the discounted cash flow is as follows:

In this formula it can be understood that:

-

- FC: Cash flow can be obtained from the income statement, as well as from the company's cash flow statement.

-

- Normally always take the current cash flow and is projected to the future years (n)for example, 2, 4, 6, 10 years...

-

- r: The discount rate, also referred to in some formulas as the kis the rate at which each year's cash flows will be discounted.

-

- At this rate, the WACC as discount rateThe risk of the risk is between 8 or 15%, depending on the type of risk at the time of application of the valuation of companies.

Through the settlement value

This is one of the methods for calculating enterprise valuation which is generally used in some cases. It consists of estimating the value of a business, assuming that all of its assets would be sold at a reasonable price in the current market.

It is by far the most accurate method for valuation of companies, as it is based on an estimate. However, it is also one of the most commonly used to recreate an estimated value of the company in a short time.

Although this method is not as subject to calculations or mathematical formulas as in the case of cash flows, it can yield short-term results because it is adjusted to current market prices, and takes into account each of the assets owned by the company and the estimated prices of each of these.

However, it does not come close to discounted cash flow method in a valorization of companiesIt only represents an idea of how much a company is worth because of what it owns. In other words, it is not a formula to value your company accurately.

As its name indicates, it is based on liquidation and will be subject only to the current value of the assets, without considering other present aspects.

By the book value method

This method consists of achieving a valorization of companies which is directly reflected in the balance sheet. It can be calculated by subtracting the total value of assets from the total value of liabilities, which, in turn, is what the company's net worth is known as.

A very simple example of this is that if the total value of the assets is 1 million dollars (USD) and the total liabilities are 600,000$ (USD), the equity of the company will be about 400,000$ (USD), since this is the remainder of what is left.

This is undoubtedly a simple formula to enhance the value of your companybecause it comes from information held by the company at all times, at any time of the year.

However, even though it is a simple method in the valorization of companiesis not subject to future calculations, is only based on present reality and is not always the most reliable.

For this reason, it is generally recommended to always perform the discounted cash flow method for an accurate valuation of companies.

Through goodwill

Goodwill consists of a company's ability to generate any type of profit through its intangible assets. In other words, the company will generate profits thanks to its brand and its human capital; its employees. This variable is considered to be one of the most difficult to determine for a company. valorization of companiesThe value of the product can be quantified, since it cannot usually be quantified concretely.

Normally this formula for enhancing the value of your business will determine how much the sale of a company will produce, by the difference between what the sale generated and the present book value.

An example quite similar to the book value method is that if a company has a book value of $90 million (USD) and is sold for about $100 million (USD), the goodwill will be about $10 million (USD).

Through the multiple by sales

This method for the valorization of companies is based solely on the value of the sales that the company has obtained. The calculation is quite simple: you simply multiply the sales by a certain figure.

For example, if the company had a sale of 1.000$ (USD), the analysts will determine what the corresponding figure is for that sale. If it is 5, they will multiply that sale by 5. Then the value generated by the company is 5.000$ (USD), with a single sale.

The present problem of this formula to enhance the value of your company lies in the fact that everything is subjective, and will only be supported by the interpretations agreed upon by analysts.

How to perform a company valuation correctly?

Thanks to valoriza.comyou can get the peace of mind you need by obtaining a valorization of companies fair and subject to precise and accurate calculations.

We invite you to contact us so that we can provide you with more help and information about business valuation.