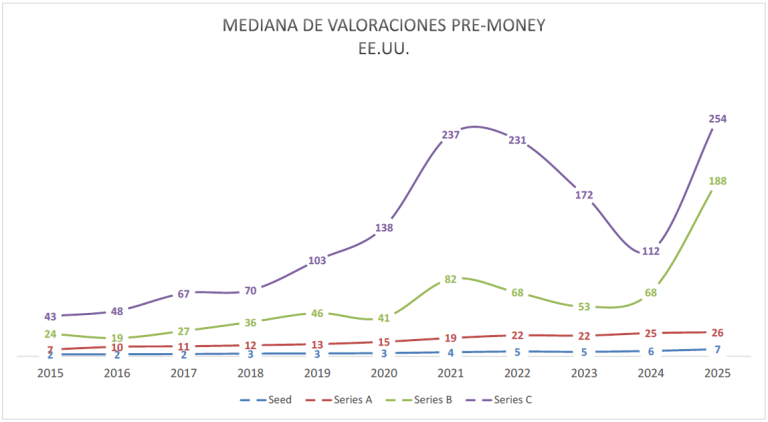

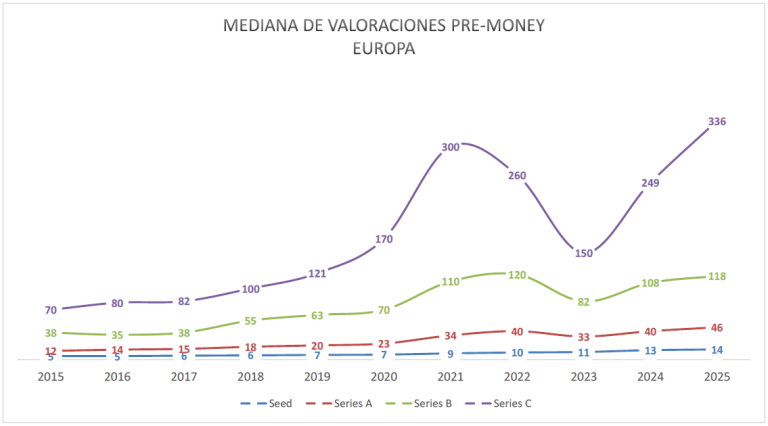

In conjunction with the Diario FinancieroIn this section, we conducted an analysis of the Pre-Money valuations in 2025. Among other things, we determined that a rebound to 2021 levels is being shown in all series. Between 2015 and 2021, in both the U.S. and Europe, there was an upward trend in company valuations, peaking in 2021.

After a dip during 2022 and 2023 in the U.S., 2024 rebounded, and 2025 confirms an upward trend. In Europe, although Series B and C were the most affected by the downturn (or correction), 2025 also reflects a shift in the curve back to 2021 levels, with 499 deals recorded to date.

"So far in 2025, with almost 1,600 transactions, Pre-Money valuations appear to be back to 2021 levels in the US and Europe. However, a significant gap persists, with valuations in the US being 42% (average of the gaps to 2025) higher than in Europe," explains Max Errazuriz, Managing Partner at Valoriza.

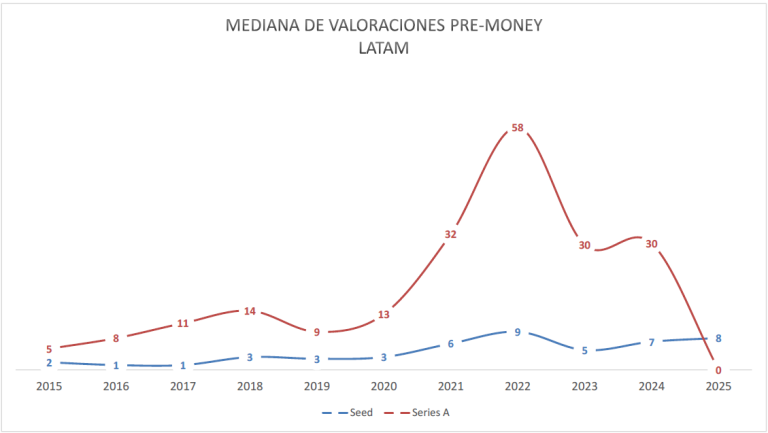

"In the case of LATAM, there is evidence of a consistent increase from 2015 to 2022 for the Seed and A series, with 350% and 1.060%, respectively. However, in 2023 both series show declines of 44% and 48%, but only the Seed series rises in 2024," said Tomás Sánchez, partner of the firm.

Gap analysis between geographies

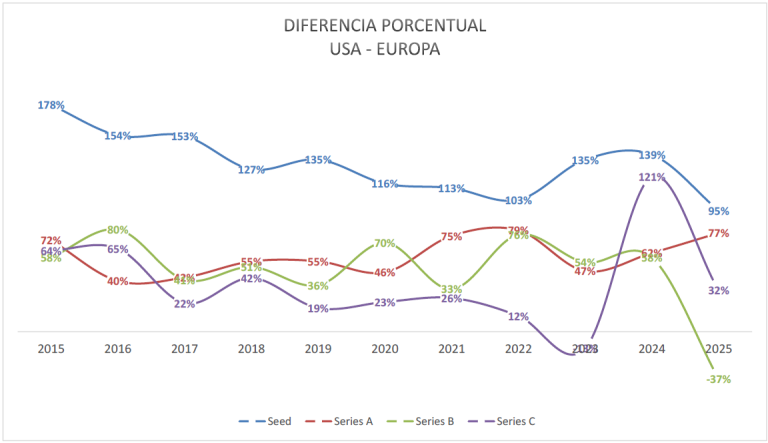

The valuation gap is consistently and vastly superior in the United States in all rounds. The differences in the Pre-Money valuations between the U.S. and Europe are higher in earlier rounds of capital raising (Seed Series are on average 132% higher in the U.S. versus Europe for the last 10 years, considering 2025).

"While the differences in Pre-Money valuations are gradually falling as the rounds get more advanced, in the C series there is still a difference of 32% in favor of the United States," says Sanchez.

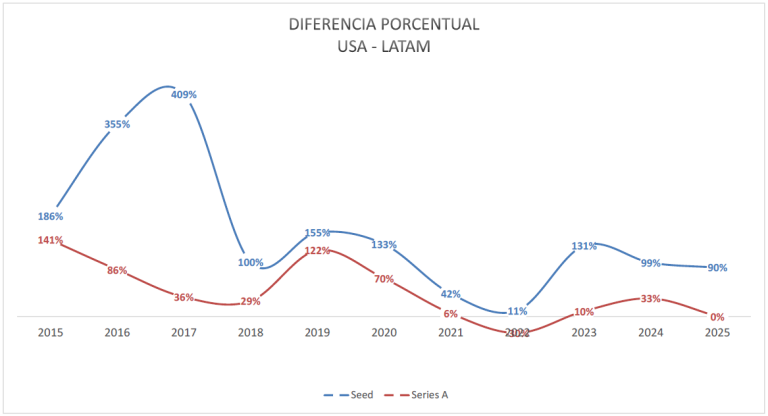

"For Latam, the gaps with respect to the US are clear. For the period between 2015 and 2025, average gaps of 156% and 50% are evident for the Seed and A Series, respectively," says Errázuriz.

"Although the gaps tend to narrow over the period for both series, they persist towards 2024 with differences of 99% and 33% respectively," the financier continued.

Convergence analysis of Pre-Money valuations

Since 2015, there has been a gradual convergence of the valuations between geographieswhich breaks down in 2022. From 2015 to 2021-22 there was a noticeable downward trend in the differences of Pre-Money valuation between the United States and Europe in the Seed Series, which is reversed post-pandemic, reaching 139% of differences in the inter-market valuations the year 2024. This uptick in post-pandemic differences occurs in both early and late rounds (Series A, B and C).

"In 2015 the valuation gap in the B series was 58%, with the gap narrowing to 33% in 2021. However, we see how the 2024 numbers show that the gap between the U.S. and Europe increases again to 58%," said Pablo Vergara, Consultant at Valoriza.

Between the U.S. and Latam, there is a marked convergence between 2015 and 2018, and that trend continues until 2022, and diverges again in recent years. Last year. The valuations in the United States were almost double in the Seed series, and 33% higher in the A series," says Sanchez.

Volatility analysis

Series C is the most volatile in the comparison between the US and Europe. Unlike other stages, Series C shows significant fluctuations, going from a gap of 64% by 2015 in favor of the U.S. to 121% by 2024 in favor of the U.S. again.

2025 shows an anomaly in the B Series. While in almost every year the difference in Series B valuations favors the U.S. (positive values), in 2025 there is a drastic change, with Europe being 37% above the U.S. (it is important to consider that for this round in 2025 only 112 Deals were considered in the U.S. and 43 in Europe).

In the case of Latam, there is some consistency for the Seed and A series, while the B and C series were omitted, since the low volume does not allow for a rigorous analysis.

Europe vs Latam

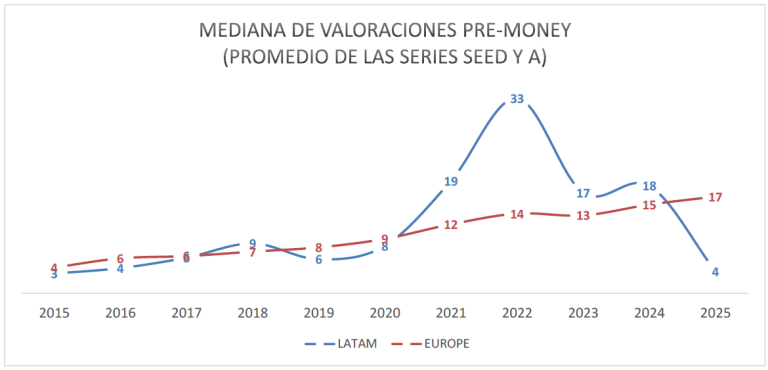

The valuation of Europe and Latin America show similar trends and orders of magnitude in terms of valuations.

Europe is more consistent in its upward trend while LATAM tends to have ups and downs and a peak in 2022 where the gap reaches 135% in favor of Latin America, to return to historical differences during the last years.

Looking for a fair valuation for your startup?

At Valorize we are experts in financial consulting and startup valuation. We help you determine the fair value of your company, with internationally recognized methodologies and a strategic view that enhances your negotiation capacity.

Contact us at here and turn your vision into a real opportunity for growth.